Besides tax-freakout-time, April is financial literacy month. I have a bunch of content suggestions for you to explore finances! Anything from books to online courses!

Let me be part of the team! Please consider joining this newsletter or the one-on-one coaching program. You can also recommend my seminars to your graduate program/fellowship office, or send my website to your graduate program chat/slack/email list. Looking forward to connecting with many of you 🥰

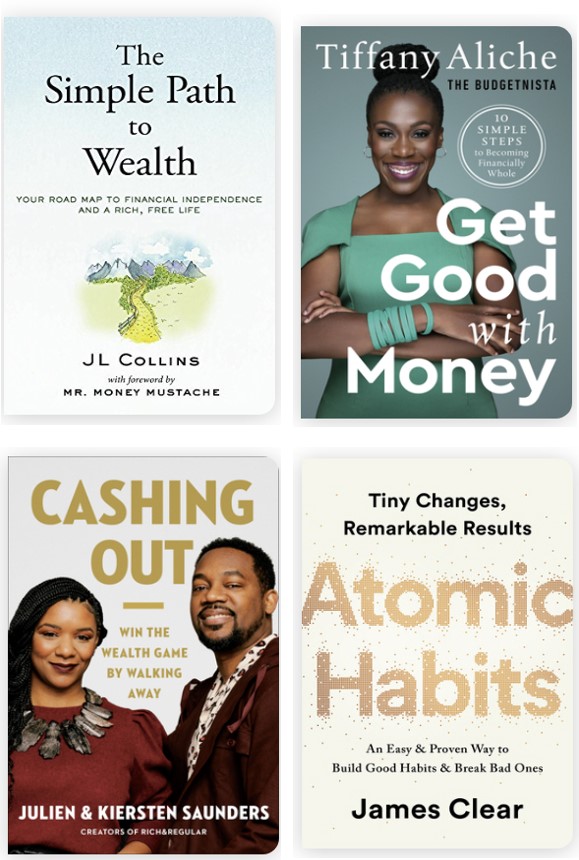

Books

If you love reading and would like to try some great first hand accounts on how to tackle personal finances and habit formation, these books are a great start!

The Simple Path to Wealth by JL Collins

Jump started my household’s investing journey. A dad writes a series of letters addressed to his adult daughter who does not want to spend her life thinking about personal finance.

Get Good with Money by Tiffany Aliche

A former kindergarten teacher, writes the lessons to reach “financial wholeness” which she has learned while becoming the public figure known as the Budgetnista.

Cashing Out by Julien & Kiersten Saunders

An amazing couple sharing their financial story from corporate America towards entrepreneurship. They introduce the concept of the 15 year career while discussing money and racial disparities

A life changing book that I wished I read during graduate school, and I am currently recommending to everybody. The teachings can absolutely be applied to personal finance, even if the book is not personal finance

Documentaries

Are you feeling more like watching a movie and enjoying some popcorn? From general to specific topics, these two documentaries are right for you!

Get Smart with Money, Netflix Film

Four individuals undergo financial coaching for a year under the guidance of 4 great coaches. Each person is tackling a different financial challenge like credit card debt, FIRE, entrepreneurship, and starting to invest.

Playing with FIRE by Scott Rieckens

A couple writes a list of the 10 things that bring them the most joy and their house on the beach does not make it to their list. This activity propels their documented one year journey to jump start their trip towards Financial Independence and Retire Early (FIRE).

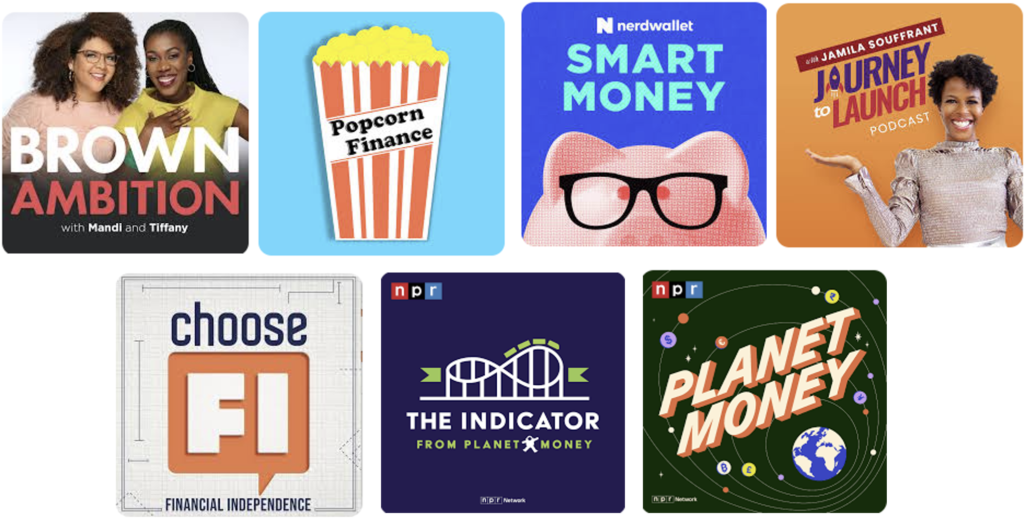

Podcasts

There is a podcast for everything, says every millennial. But, it is true there is a podcast for every level of personal finance. I follow a combination of entrepreneurs, financial media, and public radio.

Brown Ambition by Tiffany Aliche and Mandi Woodruff-Santos

Tiffany and Mandi are your financial besties and they tackle career, money, businesses, while being a woman of color. They have two weekly episodes, one on Wednesdays and the second one is a Q&A format on Friday.

Popcorn Finance by Chris Browning

Chris breaks down financial topics “in about the time it takes to make a bag of popcorn.” I love his approach to finances, his candor, his voice, the fact that is a foodie, and all the guests he brings. He has one episode a week released on Tuesdays.

Smart Money Podcast by Nerdwallet

Sean Pyles and in many episodes Liz Weston, answer your money questions with the help of financial nerds! All the questions are submitted by listeners that are living life, so we get to learn about retirement, investing, banking, family relationships and happiness.

Dr. Emily Roberts has curated unique content tailored specifically to graduate students. She is an expert on personal finance, is my go to site for tax question as I have purchased one of her digital products. Her weekly podcast covers anything from funding to entrepreneurship. Definitely worth a listen!

Journey to Launch by Jamila Souffrant

Jamila has documented her own journey to pursue FIRE since 2015, when she had a 2 hour commute and was, as she says, very pregnant. Today, in her podcast she gives you the inspiration you need to launch your financial freedom journey.

Choose FI by Brad Berret and Jonathan Mendonsa

If you want to explore the concept of FIRE, Brad and his guests break down the most current topics and trending issues within the Financial Independence community. I enjoy their actionable advice every Monday, their weekly newsletter every Tuesday, and one day I wish to be interviewed by them.

Economics related by not specifically personal finance

The Indicator and Planet Money by NPR

These two podcasts have made me heavily interested in economics. I bought their comic book called MicroFace, downloaded their song Inflation from their new record label, learned about patents and race, and look forward to their version of the Oscars called the Beigies. Their humor is full of nerdiness and I am here for it!

Online Courses

The Federal Deposit Insurance Corporation (FDIC) is an independent federal agency insuring deposits in U.S. banks and thrifts in the event of bank failures. They also have an awesome catalog of financial courses for young people, young adults, adults, older adults, and small business owners. The courses range from coloring books regarding the economy to avoiding scams targeting the elderly. Money Smart has a course for everybody!

Khan Academy, Personal Finance

Lots of science majors are familiar with Khan Academy and their videos that explain the Kreb’s cycle. Well Khan academy, has a section called life skills that targets personal finance, careers, and entrepreneurship. The personal finance course topics are wide and include but are not limited to savings, budgeting, income, benefits, housing and car expenses.

What an amazing collection of resources! Thank you so much for putting this together, I can’t wait to come back to it and check more off my “to read” lists!