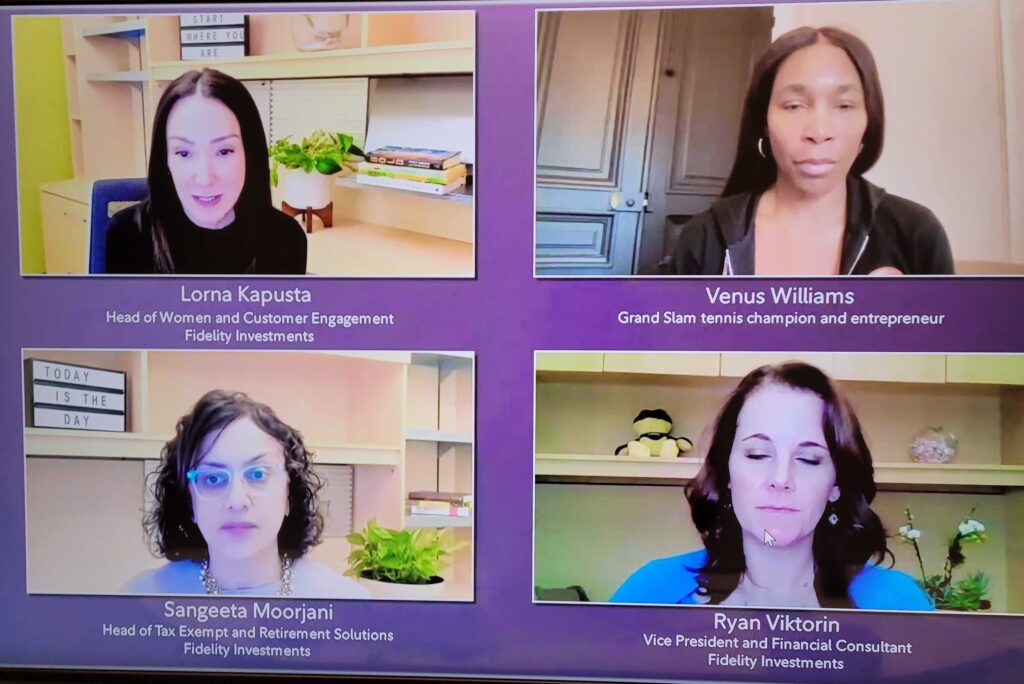

Better late than never. March is the month in which my new year’s resolutions usually die. Life gets busy, tax season gets me very stressed, and I simply want to revert to the comfy zone. Thankfully, a Fidelity seminar featuring Venus Williams reminded me to write my personal finance newsletter! If you have a Fidelity account, I would definitely recommend joining their Women Talk Money Seminar Series. In this seminar Fidelity executives(Lorna Kaputa, Sangeeta Moorjani, and Ryan Viktorin) and Venus Williams chatted about knowing, and growing, your worth every day.

The various speakers talked a lot about the role of fear in personal finance. I think the biggest takeaways from the speakers was to use fear as fuel instead of freezing over fear.

I believe personal finance is a part of our overall health. I also am a strong believer of mental health advocacy. In therapy, I have learned that focusing on what I have control over, is liberating. Letting go of the things I cannot change and focusing on what it is within my power. Here is where personal finance gets tricky. We are constantly being bombarded by headlines of things we cannot control, such as what inflation is today and how there is a looming recession. All of this negative talk can make us think that finances are out of our control. I invite you to use the fear inducing headlines as fuel to work on the part of personal finance that we CAN control.

Are you concerned about the Silicon Valley Bank collapse? Investigate what the FDIC role is in deposit insurance. If you take some time to read about this, you will find that the FDIC’s protection secures up to $250K per individual per institution. So if my bank account balance at Chase is less than $250,000 I literally have no reason to worry.

The second takeaway was to think of yourself as the Chief Executive Officer (CEO) of your financial life. What do you think a CEO of a company does to make a company successful? When I think of a CEO I think of a confident person that is surrounded by a team of experts, they all work together to make decisions based on data and projections. Together with the team of experts the CEO determines and prepares for upcoming challenges, how to tackle them, and where the company is going. So, how was quarter 1 (Q1) of your financial life?

Shameless plug, let me be part of the team that advises you, the CEO of a financial life. Please consider joining this newsletter or the one-on-one coaching program. You can also recommend my seminars to your graduate program/fellowship office, or send my website to your graduate program chat/slack/email list. Looking forward to connecting with many of you 🥰