For me, January is a time for personal assessment and setting up realistic resolutions for my personal or professional life. I also do this exercise with my household’s financial health. My husband and I start by reflecting on how did 2022 go? What were our 2022 wins? What did not work for us in 2022? Most importantly, what can our 2023 look like?

As a scientist, I love data. I like to collect it, analyze it, graph it, and show it to others. Thanks to the podcast “Personal Finance for PhDs,” I started exploring personal finance as a scientist during graduate school a couple of months before the pandemic started. Today, my household is super interested in finances and we have money talks every other week over Saturday breakfast. But it didn’t look like this from the beginning, and most likely it won’t look like that for you. One of my favorite phrases is that personal finance is personal. Maybe you have never had a money date with yourself, and that is okay! My goal is to provide the necessary tools that money dates can happen over a bottle of wine, be fun, and re-framed as positive experiences, instead of stressful conversations.

The year 2022 was a year full of firsts for my household. I earned a PhD and transitioned to industry, resulting in a salary increase of $55,000. For the first time in my 10 years of working in a lab, I have access to a retirement match program (8%). I started this business, in which I provide financial coaching for graduate students for free. Two graduate students signed up for this financial coaching (see their reviews here). I made the very website you are reading this!

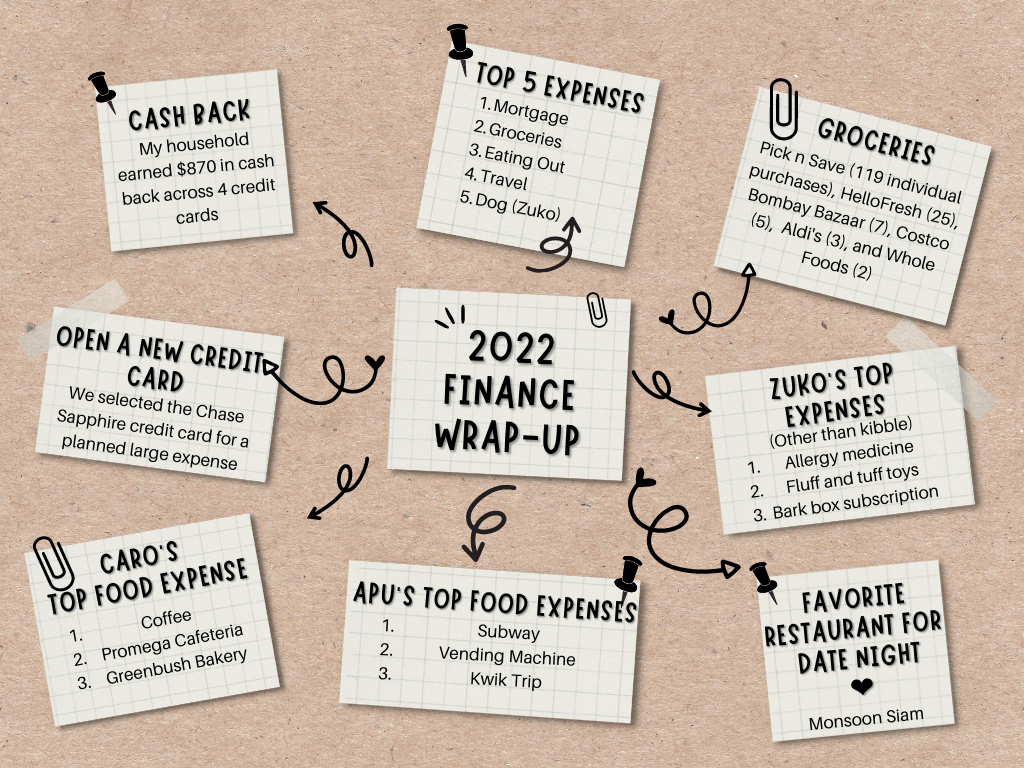

My household opened a new credit card, which is VERY exciting for us. We earned $870 in credit card rewards and used a lot of it for our holiday gifts for our loved ones. Our top spending categories after housing were groceries, eating out, and our dog (Zuko). My top spending category for eating out were coffee shops, which I visited 60 times. My husband seemed to love Subway for lunch when he went in person to the office. My dog was the recipient of 10 amazon packages that included treats and many fluff and tuff toys.

My goal for 2023 is to grow “Finances with Carolina LLC” clientele. Thus, I am going to use this newsletter as an accountability partner. Please consider joining this newsletter, the one-on-one coaching program, or recommending my seminars to your graduate program. Looking forward to connecting this 2023 🙂

Hi! It’s great to hear about your healthy relationship with budgeting and tracking goals. I especially appreciate that you have no judgment about any of the spending for the year– you see it as just interesting data for you/your family. That might be a useful note for me when considering the year’s spending. How do I feel about my budget and spending? Thanks for sharing!

[…] Review Your Financial Health […]