As the summer sun fades, there’s a palpable energy in the air. If you are a first year student, welcome to your graduate program! If you graduate this summer, congratulations on defending! I have always considered fall as a renewed sense of beginning, it’s a season that often inspires reflection and growth for me. I do fall-cleaning and evaluate what the are goals for the last third of the year in my household.

Below are some facts/reminders for this new fall semester. These are very nice to share with the first year’s in your labs, programs, communities, etc.

My business is here for you!

At Finances with Carolina, we work on personal finance at ANY level, no judgment, just all the help! Whether you are a new student or you are starting your first post-PhD job, check out coaching and encourage your institution to host a seminar.

Fellowship income is taxable income

I learned this from Dr. Emily Roberts’ podcast Personal Finance for PhDs in my first year. Her tax resources were extremely helpful and affordable for me, as a funded student for the entirety of my PhD. Do not get a surprise bill when filling your taxes in April 2024!

Students receiving fellowship/training can be invested in a Roth Individual Retirement Account (IRA)

In 2019, fellowship and training grant income became eligible for Roth IRA contributions as it is taxable income (see point 2). Since this change is relatively recent, I want to make sure every student knows that this is an option for them, regardless of their income type. I have my Roth IRA account with Vanguard.

High Yield Savings Accounts (HYSA) will pay you more in interest than large banks

Whether you are paid monthly, biweekly or once a semester, HYSAs are a good fit for graduate students. I used them during graduate school and today to plan for large irregular expenses, like car insurance or student fees. Today, my household’s emergency fund lives happily in one of these accounts. Ally, Synchrony, and SoFi are some examples of online banks that offer these types of accounts. I have had an account with Ally since 2019.

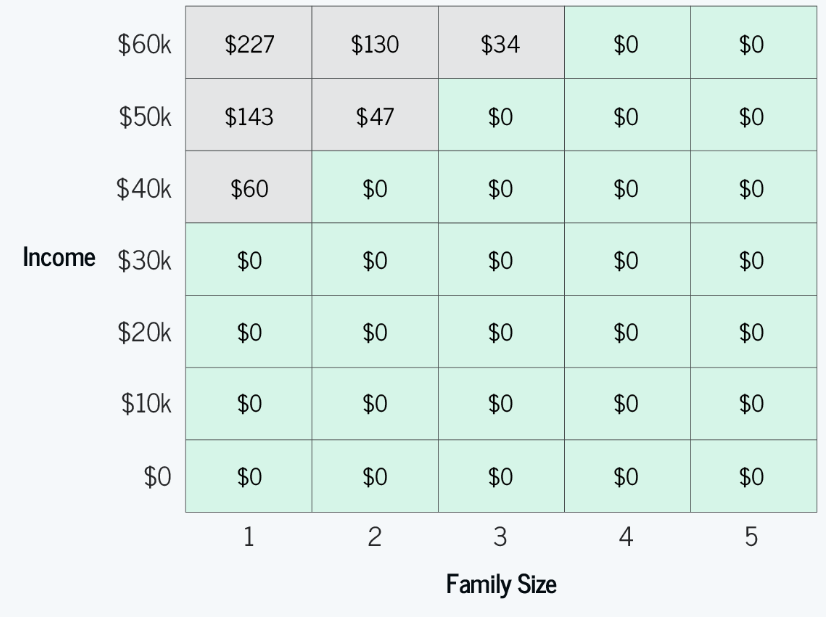

Student Loans Repayment during graduate school, is it for you?

The Biden-Harris’ Saving on a Valuable Education (SAVE) income-driven repayment plan can result in $0 payments for graduate students. Below is an estimation of what a hypothetical graduate student’s payments might look like for you based on income and household size

Let’s empower each other on our financial journeys, new students that sign up for this newsletter will get my toolkit FOR FREE. If you have any questions or need further guidance, don’t hesitate to reach out at financeswithcarolina@gmail.com. I am here to support you every step of the way!